Introduction: The Mirage of Modern Luxury

Over the past few years, Dubai has become the poster child of modern luxury, opportunity, and seemingly endless growth. Billboards, Instagram reels, and YouTube ads shout from the rooftops about how you can move to Dubai, start a business, invest in real estate, or enjoy a tax-free lifestyle with ease. From Bollywood celebrities endorsing luxury apartments to influencers flaunting skyline views from their penthouses, Dubai has mastered the art of aspiration marketing.

But beneath the glossy brochures and glamorous videos lies a narrative that’s less often talked about: Is Dubai building an economic bubble that’s primed to burst? This blog explores the growing concerns surrounding the Dubai real estate bubble and what it means for investors, expats, and dreamers alike.

Section 1: The Allure of Dubai – What’s Drawing the World In

1.1 Tax-Free Heaven

Dubai has no personal income tax, no capital gains tax, and low corporate taxes. This is a major draw for global entrepreneurs, remote workers, and high-net-worth individuals fleeing heavily taxed nations.

1.2 Real Estate as a Golden Ticket

With the introduction of the Golden Visa and 100% foreign ownership in businesses and property, Dubai is presenting itself as a land of limitless opportunity. Real estate, especially, has seen a boom, with prices rising over 30% in some locations post-COVID, fueling what many now see as the Dubai real estate bubble.

1.3 Visa Reforms and Digital Nomad Schemes

Dubai now offers:

- 10-year Golden Visas

- 5-year retirement visas

- Remote Work Visas for digital nomads

On paper, these reforms seem like a revolutionary step toward making Dubai a permanent global hub.

Also read – 7 Proven Methods To Safely Exit Non Performing Stocks

Section 2: What Lies Beneath – Cracks in the Golden Façade

2.1 No Real Citizenship, Just Residency

Let’s clear this up: Dubai (or the UAE) does not offer citizenship to expats. You can live there for decades, invest millions, yet never become a true citizen. Residency is always at the discretion of the government.

If political winds change or the government reverses its policies, you could be asked to leave.

2.2 Real Estate Bubble Brewing?

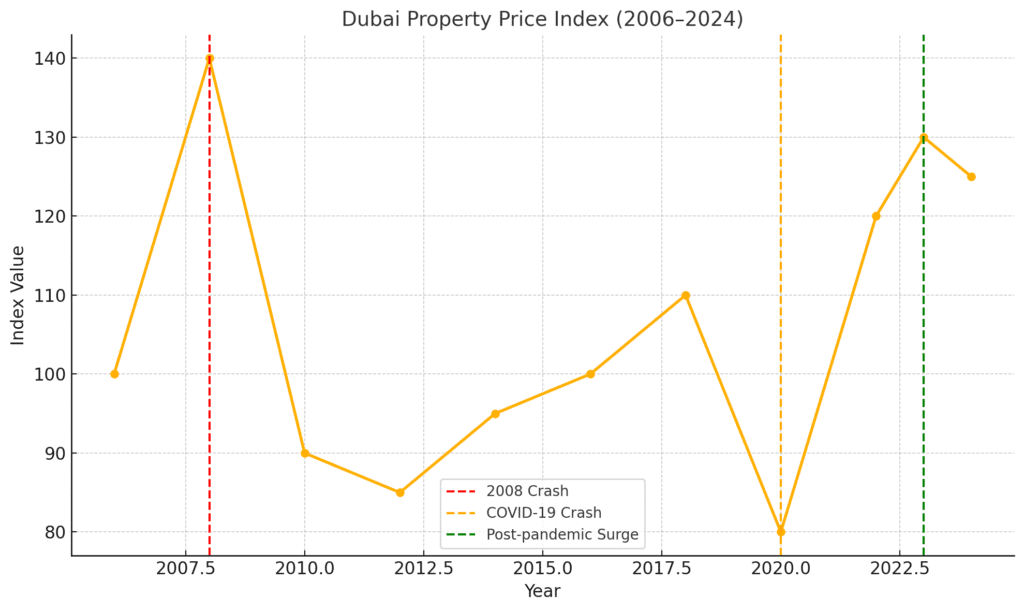

Dubai’s real estate market has gone through multiple cycles of boom and bust.

- In 2008, it collapsed spectacularly during the global financial crisis.

- In 2020, prices tanked again due to COVID-19.

Post-pandemic, prices rebounded rapidly, but this surge is driven largely by speculative investors and foreigners, not end-users. Many luxury projects promise “guaranteed returns” or “ROI of 10%”, which are often red flags in any market. These trends are fueling the Dubai real estate bubble, creating a cycle that could end in another collapse.

2.3 Ghost Towers & Empty Luxury Units

- As of 2011, up to 40% of buildings in Dubai were reported vacant—higher than Detroit’s vacancy rate.

- Prime areas see 15–20% of residences owned by absentee investors that remain unoccupied.

- Jumeirah Beach Residence’s “Shams 1” sat empty for nearly a decade post-completion.

- Entire zones like Dubai South and parts of Business Bay are underutilized or eerily quiet, signaling excessive supply.

These ghost towers are more than symbolic—they represent capital sitting idle, contributing further to the instability of the Dubai real estate bubble.

Section 3: Economic Dependence & Vulnerabilities

3.1 Heavy Reliance on Real Estate & Tourism

Dubai’s economy is diversified on paper, but in reality, it is highly dependent on real estate and tourism. These sectors are both highly cyclical and vulnerable to global shocks. This overdependence raises serious questions about the sustainability of the Dubai real estate bubble.

A sudden dip in global travel, a geopolitical conflict, or a financial crash could send Dubai’s economy into a spiral.

3.2 Artificial Demand Creation

Free cars with apartments. Guaranteed buy-backs. Zero down payments. These are classic tactics used to create artificial demand.

It feels eerily similar to what happened in the 2008 U.S. housing market. The difference? Dubai lacks the same level of regulatory oversight. Such marketing schemes only inflate the Dubai real estate bubble, not actual demand.

3.3 Debt-Fueled Growth

Dubai World’s debt crisis in 2009 shook investor confidence globally. Today, many of Dubai’s mega projects are still funded through aggressive borrowing and foreign capital, creating a fragile financial ecosystem at the core of the Dubai real estate bubble.

Section 4: Geopolitical Risks & Legal Insecurities

4.1 Shifting Political Alliances

While Dubai enjoys relative political stability, its geographic location puts it in a volatile neighborhood. Any regional conflict can severely impact investor sentiment and tourism.

4.2 Lack of Legal Recourse

Expats have limited legal recourse in Dubai. Contracts often favor developers, and there have been multiple reports of:

- Delayed projects

- Sudden policy shifts

- No compensation for project cancellations

In case of a dispute, the legal system tends to side with locals or institutions, not expats.

Section 5: Social Engineering or Sustainable Living?

5.1 Not Built for Everyone

Dubai is marketed as a cosmopolitan city, but beneath the surface, it has deep social and economic divides.

- Laborers from South Asia often live in poor conditions.

- The city caters mostly to the ultra-rich, while middle-class families struggle with high rents and cost of living.

5.2 The Illusion of Inclusivity

The glamorous lifestyle is only accessible to a sliver of the population. For the rest, it’s a city of hyper-surveillance, limited rights, and no political voice.

5.3 Environmental Unsustainability

Dubai consumes massive energy to keep the city cool and powered. Water is desalinated using energy-intensive methods, and the carbon footprint is enormous.

Section 6: The Marketing Trap

6.1 Influencer-Led Perception Engineering

A large number of influencers are paid to create content showing Dubai as a paradise. Real estate agencies sponsor luxury lifestyle vlogs to attract foreign investors.

This perception manipulation is powerful but misleading.

6.2 SEO & Digital Warfare

Search for anything positive about Dubai and you’ll find thousands of posts, videos, and blogs. The government and private firms spend millions on SEO, Google ads, and content marketing to bury negative coverage.

Truth becomes hard to find when it’s algorithmically drowned.

Section 7: Scams, Laundering & Project Failures

7.1 Dirty Money in Pristine Towers

- Investigations by OCCRP revealed ties between Dubai properties and criminals, including drug traffickers and fraudsters.

- OneCoin’s “Cryptoqueen” Ruja Ignatova invested in Dubai real estate while under indictment.

- Properties in Palm Jumeirah and Business Bay were traced to global money laundering operations.

7.2 Developer Fraud & Mismanagement

- Union Properties was caught in a $42 million misappropriation scandal in 2022.

- Schön Properties had its assets seized after failing to deliver promised projects.

- Dubai Pearl, once a landmark vision, was demolished in 2023 after years of abandonment.

7.3 Vanishing Promises & Fake Brokers

- The Aston Plaza and Residences project promised Bitcoin payments and luxury apartments but halted after 32% completion.

- Fake agents and brokerages have scammed renters and investors through fake listings and false promises.

7.4 No Safety Net

Unlike Western countries, there is no government protection or insurance for failed projects. You lose your money. Period.

Section 8: Is Dubai a House of Cards?

Expert Voices & Market Signals

Several respected experts and institutions have raised red flags about Dubai’s overheated property sector:

- Fitch Ratings warned of a likely double-digit fall in Dubai property prices by 2026 due to record oversupply and inflated valuations.“Dubai real estate prices likely to face a double‑digit fall after years of boom… a record increase in supply … is likely to cause prices to fall by no more than 15%.” – Fitch Ratings (Reuters, May 2025)

- Nasser al‑Shaikh, Dubai’s former finance chief, expressed concern:“My worry is the state of the global economy… whatever happens in other places affects us.” (Reuters, Jan 2024)

- Hakim Abdeljaouad, valuation expert at Kroll:“Although Russian and Chinese inflows are slowly tapering off, increased interest from Indian investors could keep any downturn swift and shallow.” (Reuters, Jan 2024)

- According to UBS’s Global Real Estate Bubble Index, Dubai ranks as one of the fastest-rising bubble-risk cities globally, with speculative buying and influencer-led perception contributing to the risk.

These insights from independent experts reinforce the signals of unsustainable growth, warning investors to evaluate the risks with clear-eyed judgment.

8.1 The Warning Signs

- Soaring prices not backed by demand

- Mass influx of short-term investors

- Overreliance on marketing, influencers, and digital perception

- No long-term rights for residents

These are all classic symptoms of a bubble.

8.2 The Smart Investor’s Checklist

Before investing in Dubai, ask:

- Is the ROI sustainable?

- Who is the end-user of this property?

- What legal protection do I have?

- Can I exit easily if the market turns?

Section 9: Case Study – Dubai Pearl: A Mega Dream Gone Bust

Dubai Pearl was launched in 2002 as a $4 billion mega-development featuring luxury towers, a hotel, and residential spaces. It was marketed as a new crown jewel of Dubai, but it never moved beyond partial construction. Over 20 years, the site became a decaying skeleton, symbolizing broken investor dreams. In 2023, it was finally demolished, with zero compensation for many early investors.

The lesson? Even government-backed or high-profile projects can fail in Dubai without accountability.

Section 10: Global Parallels – When Bubbles Pop

Dubai isn’t the first city to suffer from speculative real estate fever. China’s infamous ghost cities, especially in places like Ordos, were built on similar premises: urban growth and future demand. But oversupply and debt crushed investor returns.

From Las Vegas in 2008 to Malaysia’s Forest City—speculative urban development without actual demand often ends in collapse, not celebration.

Section 11: Investor Psychology – FOMO and Fantasy

The idea of “missing out” on Dubai’s rise creates emotional investment before financial analysis. Flashy videos, fast money stories, and celeb endorsements trigger dopamine, not logic.

Investors need to understand:

- You’re not buying a home—you’re buying into a system that may prioritize image over substance.

- Rental yields and appreciation projections can be engineered, not organic.

Conclusion: Be Aware. Be Smart. Be Skeptical.

Dubai is not a scam. But it is a highly managed economic mirage. The opportunities are real, but so are the risks.

In a world obsessed with quick gains and shiny promises, caution is the real luxury. As with any market, the glitter does not always mean gold.

Dubai might be the city of the future, but that doesn’t mean your future belongs in it.

Keywords

Dubai investment risks, Dubai real estate bubble, Dubai citizenship scam, Is Dubai a safe investment, Dubai property fraud, Golden Visa UAE, Dubai residency problems, Dubai real estate 2025, Dubai influencers exposed, Dubai expat issues, Investing in Dubai 2025, Dubai economic bubble, UAE investment risks, Real estate scams in Dubai, Dubai housing oversupply, Dubai tourism economy, Dubai investor beware, Dubai real estate warning, Should I invest in Dubai, Dubai expat legal rights